Play Text-to-Speech:

Fundamental analysis is the bedrock of intelligent investing. It involves evaluating a company’s financial health, performance, and prospects to determine its intrinsic value. Unlike technical analysis, which focuses on price trends and market behavior, fundamental analysis dives deep into a company’s financial statements, competitive position, industry environment, and broader economic factors. This comprehensive approach helps investors make informed decisions about buying, holding, or selling stocks, aiming for long-term gains rather than short-term fluctuations.

In this extensive article, we will explore the key components of fundamental analysis, how to perform it, and how it can guide your stock investment decisions.

Table of Contents

- Introduction to Fundamental Analysis

- Definition and Importance

- Fundamental vs. Technical Analysis

- The Goal of Fundamental Analysis

- Key Components of Fundamental Analysis

- Economic Analysis

- Industry Analysis

- Company Analysis

- Financial Statements: The Core of Fundamental Analysis

- Understanding the Balance Sheet

- Analyzing the Income Statement

- Cash Flow Statement: The Lifeblood of a Business

- Financial Ratios and Metrics

- Profitability Ratios

- Liquidity Ratios

- Solvency Ratios

- Efficiency Ratios

- Valuation Ratios

- Qualitative Factors in Fundamental Analysis

- Management Quality

- Competitive Advantage (Moat)

- Corporate Governance

- Market Position and Brand Value

- Earnings and Growth Analysis

- Earnings Per Share (EPS)

- Price-to-Earnings (P/E) Ratio

- Growth Rate Analysis

- Dividend Yield and Payout Ratio

- Intrinsic Value Estimation

- Discounted Cash Flow (DCF) Analysis

- Dividend Discount Model (DDM)

- Relative Valuation

- Macro-Economic Factors and Their Impact

- Interest Rates and Inflation

- Economic Cycles

- Government Policy and Regulation

- Global Events and Trends

- Case Studies: Real-World Applications of Fundamental Analysis

- Case Study 1: Analyzing a Blue-Chip Stock

- Case Study 2: Evaluating a Growth Stock

- Case Study 3: Identifying Value Stocks

- Limitations and Challenges of Fundamental Analysis

- Market Efficiency Hypothesis

- Unpredictable External Factors

- The Time-Consuming Nature of Fundamental Analysis

- Biases and Subjectivity

- Integrating Fundamental Analysis with Other Strategies

- Combining with Technical Analysis

- Using Quantitative Analysis

- Integrating Sentiment Analysis

- Long-Term vs. Short-Term Perspectives

- Conclusion: The Path to Informed Investment Decisions

- Recap of Fundamental Analysis Importance

- Final Thoughts on Building a Robust Investment Strategy

1. Introduction to Fundamental Analysis

Definition and Importance

Fundamental analysis is the methodical process of evaluating a stock by analyzing the financial statements of a company, understanding the industry it operates in, and assessing the broader economic factors that might affect the company’s performance. The primary aim is to determine a company’s intrinsic value, which can help investors decide whether a stock is undervalued, overvalued, or fairly priced.

This approach contrasts with technical analysis, which is more focused on predicting price movements based on historical price data and volume. While technical analysis is often used for short-term trading, fundamental analysis is more suited to long-term investing.

Fundamental vs. Technical Analysis

- Fundamental Analysis: Looks at the “why” behind a company’s performance, focusing on the financial health and growth potential of the business.

- Technical Analysis: Focuses on the “when” to buy or sell, based on chart patterns and market trends.

Fundamental analysis provides a holistic view of a company’s potential, giving investors the confidence to invest in stocks that are likely to perform well over the long term.

The Goal of Fundamental Analysis

The ultimate goal of fundamental analysis is to determine the intrinsic value of a stock and compare it to its current market price. If the intrinsic value is higher than the market price, the stock is considered undervalued and could be a good buy. Conversely, if the intrinsic value is lower than the market price, the stock may be overvalued, suggesting it might be wise to sell or avoid buying it.

2. Key Components of Fundamental Analysis

Economic Analysis

Economic analysis examines the macroeconomic environment in which a company operates. This includes factors such as GDP growth, inflation rates, interest rates, and unemployment rates. Understanding the broader economic environment is crucial because it influences consumer behavior, business profitability, and investor sentiment.

For instance, in a booming economy with low unemployment and high consumer spending, companies are likely to experience higher sales and profits. On the other hand, during a recession, even the best-managed companies may struggle due to reduced consumer spending and tighter credit conditions.

Industry Analysis

Industry analysis involves examining the sector in which a company operates. Different industries have different growth prospects, competitive pressures, and regulatory environments. Understanding these dynamics helps investors gauge a company’s potential for success relative to its peers.

Key factors to consider in industry analysis include:

- Market Size and Growth Potential: How large is the market, and how fast is it growing?

- Competitive Landscape: Who are the main competitors, and what is the level of competition?

- Regulatory Environment: Are there any regulations that could impact the industry?

- Technological Changes: How is technology affecting the industry?

For example, the technology sector might offer high growth potential, but it is also highly competitive and subject to rapid changes. In contrast, the utility sector might offer stable returns with less competition but lower growth potential.

Company Analysis

Company analysis is the most detailed component of fundamental analysis, focusing on the individual company’s financial health, management quality, competitive position, and future prospects. This involves a deep dive into the company’s financial statements, management practices, market strategy, and growth plans.

When analyzing a company, investors should consider:

- Financial Statements: Review the balance sheet, income statement, and cash flow statement to assess the company’s financial health.

- Management: Evaluate the experience and track record of the company’s leadership team.

- Competitive Advantage: Determine what sets the company apart from its competitors.

- Growth Prospects: Analyze the company’s plans for expansion and how it intends to achieve long-term growth.

3. Financial Statements: The Core of Fundamental Analysis

Understanding the Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It shows what the company owns (assets) and what it owes (liabilities), as well as the equity invested by shareholders.

Key components of the balance sheet include:

- Assets: These are resources owned by the company, including cash, inventory, property, and equipment.

- Liabilities: These are obligations the company owes to others, such as loans, accounts payable, and bonds.

- Shareholders’ Equity: This represents the residual interest in the company’s assets after deducting liabilities.

A strong balance sheet typically features a high proportion of assets relative to liabilities, indicating that the company is financially stable and has the resources to weather economic downturns.

Analyzing the Income Statement

The income statement, also known as the profit and loss statement, shows a company’s financial performance over a specific period. It details how much revenue the company earned and what expenses it incurred, ultimately revealing the net profit or loss.

Key components of the income statement include:

- Revenue: The total income generated from the sale of goods or services.

- Cost of Goods Sold (COGS): The direct costs associated with producing goods or services sold.

- Gross Profit: Revenue minus COGS, showing the company’s profitability before operating expenses.

- Operating Expenses: These include costs related to running the business, such as salaries, rent, and utilities.

- Net Income: The profit remaining after all expenses have been deducted from revenue.

Analyzing the income statement helps investors understand how well a company is managing its costs and generating profits.

Cash Flow Statement: The Lifeblood of a Business

The cash flow statement tracks the flow of cash into and out of a company over a specific period. It provides insights into how a company generates cash, how it spends it, and its ability to meet short-term obligations.

The cash flow statement is divided into three main sections:

- Operating Activities: Cash generated or used in the company’s core business operations.

- Investing Activities: Cash spent on or generated from investments in assets like property, equipment, or securities.

- Financing Activities: Cash generated or used in financing the business, such as issuing stocks, paying dividends, or repaying debt.

A healthy cash flow is crucial for a company’s sustainability, as it ensures that the company can pay its bills, invest in growth, and return value to shareholders.

4. Financial Ratios and Metrics

Profitability Ratios

Profitability ratios measure a company’s ability to generate earnings relative to its revenue, assets, equity, or other financial metrics. These ratios are crucial in assessing the efficiency of a company in generating profit from its operations.

Key profitability ratios include:

- Gross Margin: (Gross Profit / Revenue) x 100. Indicates the percentage of revenue that exceeds the COGS.

- Operating Margin: (Operating Income / Revenue) x 100. Measures the percentage of revenue that remains after covering operating expenses.

- Net Profit Margin: (Net Income / Revenue) x 100. Shows the percentage of revenue that remains as profit after all expenses.

- Return on Assets (ROA): (Net Income / Total Assets) x 100. Indicates how efficiently a company uses its assets to generate profit.

- Return on Equity (ROE): (Net Income / Shareholders’ Equity) x 100. Measures the profitability relative to shareholders’ equity.

High profitability ratios typically indicate that a company is efficient in managing its costs and generating profits.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations using its most liquid assets. These ratios are important for evaluating a company’s financial health and its ability to avoid financial distress.

Key liquidity ratios include:

- Current Ratio: Current Assets / Current Liabilities. Indicates the company’s ability to cover short-term liabilities with short-term assets.

- Quick Ratio (Acid-Test Ratio): (Current Assets – Inventories) / Current Liabilities. Similar to the current ratio but excludes inventory, providing a more stringent test of liquidity.

- Cash Ratio: Cash and Cash Equivalents / Current Liabilities. Measures the company’s ability to pay off short-term liabilities using only its cash and cash equivalents.

A higher liquidity ratio generally indicates that a company is in a strong financial position and can easily meet its short-term obligations.

Solvency Ratios

Solvency ratios measure a company’s ability to meet its long-term obligations and are crucial in assessing financial stability. These ratios help investors understand how much debt a company has relative to its assets, equity, or earnings.

Key solvency ratios include:

- Debt-to-Equity Ratio: Total Liabilities / Shareholders’ Equity. Indicates the proportion of debt used to finance the company’s assets relative to equity.

- Interest Coverage Ratio: Operating Income / Interest Expense. Measures how easily a company can cover its interest payments with its operating income.

- Debt-to-Assets Ratio: Total Liabilities / Total Assets. Indicates the proportion of a company’s assets that are financed by debt.

Low solvency ratios suggest that a company is less reliant on debt financing, which reduces financial risk.

Efficiency Ratios

Efficiency ratios evaluate how effectively a company uses its assets and liabilities to generate revenue and manage operations. These ratios provide insights into the operational efficiency of a business.

Key efficiency ratios include:

- Inventory Turnover: COGS / Average Inventory. Measures how often a company’s inventory is sold and replaced over a period.

- Receivables Turnover: Net Credit Sales / Average Accounts Receivable. Indicates how efficiently a company collects revenue from its customers.

- Asset Turnover: Revenue / Average Total Assets. Measures how efficiently a company uses its assets to generate sales.

High efficiency ratios indicate that a company is effectively managing its resources to generate revenue.

Valuation Ratios

Valuation ratios assess the value of a company’s stock relative to its earnings, sales, or book value. These ratios are essential for determining whether a stock is overvalued, undervalued, or fairly valued.

Key valuation ratios include:

- Price-to-Earnings (P/E) Ratio: Market Price per Share / Earnings per Share. Compares a company’s stock price to its earnings, indicating how much investors are willing to pay for each dollar of earnings.

- Price-to-Book (P/B) Ratio: Market Price per Share / Book Value per Share. Compares a company’s stock price to its book value, indicating how much investors are willing to pay for each dollar of book value.

- Price-to-Sales (P/S) Ratio: Market Price per Share / Revenue per Share. Compares a company’s stock price to its revenue, indicating how much investors are willing to pay for each dollar of sales.

- Dividend Yield: Annual Dividends per Share / Market Price per Share. Measures the dividend income an investor can expect relative to the stock price.

Valuation ratios are critical in assessing whether a stock is priced appropriately relative to its fundamentals.

5. Qualitative Factors in Fundamental Analysis

Management Quality

The quality of a company’s management team plays a vital role in its success. Strong leadership can drive innovation, efficiency, and profitability, while poor management can lead to operational challenges and financial instability.

When evaluating management quality, consider factors such as:

- Experience and Track Record: How experienced is the management team, and what is their track record of success?

- Leadership Style: Is the management team known for effective leadership, transparency, and ethical practices?

- Strategic Vision: Does the management have a clear and achievable strategic vision for the company’s future?

Investors can assess management quality by reading annual reports, listening to earnings calls, and reviewing the company’s performance over time.

Competitive Advantage (Moat)

A company’s competitive advantage, or “moat,” refers to the unique factors that allow it to maintain a competitive edge over its rivals. Companies with strong moats can protect their market position and generate sustainable profits over the long term.

Common sources of competitive advantage include:

- Brand Loyalty: A strong brand that resonates with consumers.

- Cost Advantage: The ability to produce goods or services at a lower cost than competitors.

- Intellectual Property: Patents, trademarks, or proprietary technology that protects the company’s products or services.

- Network Effects: The value of a product or service increases as more people use it, creating a barrier for competitors.

Identifying companies with strong competitive advantages is key to finding long-term investment opportunities.

Corporate Governance

Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. Strong corporate governance is crucial for ensuring that a company is managed in the best interests of its shareholders.

Key aspects of corporate governance include:

- Board Structure: Is the board of directors independent, diverse, and experienced?

- Shareholder Rights: Are shareholders’ rights protected, and do they have a voice in key decisions?

- Transparency: Does the company provide clear and accurate information to its investors?

Good corporate governance reduces the risk of fraud and mismanagement, which can harm a company’s reputation and financial performance.

Market Position and Brand Value

A company’s market position and brand value are important qualitative factors that can influence its long-term success. A strong market position indicates that a company is a leader in its industry, while a valuable brand can drive customer loyalty and pricing power.

Investors should consider factors such as:

- Market Share: What percentage of the market does the company control?

- Brand Recognition: How well-known and respected is the company’s brand?

- Customer Loyalty: Does the company have a loyal customer base that generates repeat business?

Companies with strong market positions and valuable brands are often better equipped to withstand competitive pressures and economic downturns.

6. Earnings and Growth Analysis

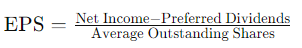

Earnings Per Share (EPS)

Earnings per share (EPS) is one of the most widely used metrics in fundamental analysis. It measures the portion of a company’s profit allocated to each outstanding share of common stock.

EPS is calculated as:

A higher EPS indicates that the company is generating more profit per share, which is generally a positive sign for investors. However, it’s important to consider EPS in the context of the company’s overall financial performance and industry trends.

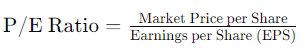

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio compares a company’s stock price to its EPS, providing a measure of how much investors are willing to pay for each dollar of earnings.

P/E Ratio is calculated as:

A high P/E ratio may indicate that investors expect strong future growth, while a low P/E ratio may suggest that the stock is undervalued or that the company’s growth prospects are limited. However, the P/E ratio should be compared to the industry average and the company’s historical P/E to gain meaningful insights.

Growth Rate Analysis

Growth rate analysis involves evaluating a company’s historical and projected growth in key financial metrics, such as revenue, earnings, and cash flow. This analysis helps investors understand whether a company is likely to continue growing at a steady pace or if its growth is slowing.

Key growth metrics include:

- Revenue Growth Rate: Measures the increase in revenue over a specific period.

- Earnings Growth Rate: Measures the increase in net income over a specific period.

- Dividend Growth Rate: Measures the increase in dividends paid to shareholders over time.

Consistent growth in these metrics is typically a positive sign, indicating that the company is expanding its business and increasing its profitability.

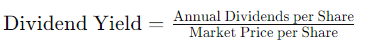

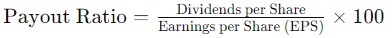

Dividend Yield and Payout Ratio

Dividends are a portion of a company’s earnings distributed to shareholders. The dividend yield measures the annual dividends paid relative to the stock price, while the payout ratio indicates the percentage of earnings paid out as dividends.

Dividend Yield is calculated as:

Payout Ratio is calculated as:

A high dividend yield can be attractive to income-seeking investors, but it’s important to ensure that the payout ratio is sustainable. A very high payout ratio might indicate that the company is paying out more than it can afford, potentially compromising its financial stability.

7. Intrinsic Value Estimation

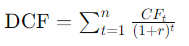

Discounted Cash Flow (DCF) Analysis

Discounted cash flow (DCF) analysis is a method used to estimate the intrinsic value of a company by calculating the present value of its expected future cash flows. This method involves projecting the company’s future cash flows and discounting them back to their present value using a discount rate.

The DCF formula is:

Where:

DCF analysis provides a detailed and rigorous valuation, but it requires accurate estimates of future cash flows and an appropriate discount rate.

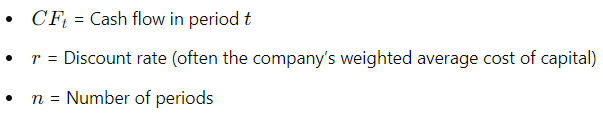

Dividend Discount Model (DDM)

The dividend discount model (DDM) is another method for estimating the intrinsic value of a stock, particularly for companies that pay consistent dividends. The DDM values a stock by summing the present value of all expected future dividends.

The simplest form of DDM is the Gordon Growth Model:

Where:

The DDM is particularly useful for valuing dividend-paying companies, but it assumes that dividends will continue to grow at a constant rate indefinitely.

Relative Valuation

Relative valuation involves comparing a company’s valuation ratios, such as the P/E ratio, P/B ratio, and EV/EBITDA, to those of similar companies in the same industry. This method helps investors determine whether a stock is undervalued or overvalued relative to its peers.

For example, if a company’s P/E ratio is significantly lower than the industry average, it might indicate that the stock is undervalued, assuming the company’s fundamentals are similar to its peers.

Relative valuation is a quick and straightforward method, but it relies on the assumption that the market has correctly valued the peer companies.

8. Macro-Economic Factors and Their Impact

Interest Rates and Inflation

Interest rates and inflation are two of the most important macroeconomic factors that influence the stock market. Interest rates affect the cost of borrowing and the return on savings, while inflation erodes purchasing power and can impact corporate profits.

- Rising Interest Rates: Generally, rising interest rates make borrowing more expensive, which can slow economic growth and reduce corporate profits. Higher interest rates can also make bonds more attractive relative to stocks, potentially leading to a decline in stock prices.

- Inflation: Moderate inflation can be positive for stocks, as it often accompanies economic growth. However, high inflation can increase costs for businesses and reduce consumer spending, leading to lower profits and stock prices.

Investors should monitor central bank policies, such as those of the Federal Reserve, as changes in interest rates and inflation expectations can have a significant impact on the stock market.

Economic Cycles

The economy moves in cycles, typically categorized as expansion, peak, contraction, and trough. Each phase of the economic cycle affects different sectors of the stock market in various ways.

- Expansion: During economic expansion, consumer spending and business investment increase, leading to higher corporate profits and rising stock prices.

- Peak: The peak of the cycle is characterized by maximum output and employment, but also by rising interest rates and inflation, which can slow growth.

- Contraction: During a contraction or recession, economic activity declines, leading to lower corporate profits and falling stock prices.

- Trough: The trough marks the lowest point of the cycle, after which the economy begins to recover.

Understanding where the economy is in the cycle can help investors make informed decisions about sector allocation and stock selection.

Government Policy and Regulation

Government policies and regulations can have a profound impact on the stock market. Tax policies, trade agreements, environmental regulations, and labor laws all influence the operating environment for businesses.

- Tax Policies: Changes in corporate tax rates can directly affect a company’s profitability. Lower taxes generally boost profits, while higher taxes can reduce them.

- Trade Policies: Tariffs and trade agreements can affect the cost of goods sold and the competitiveness of companies that rely on international trade.

- Regulations: Environmental, labor, and financial regulations can impose costs on companies or create new opportunities, depending on the nature of the regulation.

Investors should stay informed about government policies that may affect the industries or companies they invest in.

Global Events and Trends

Global events, such as geopolitical tensions, pandemics, and technological advancements, can have significant effects on the stock market. For example, the COVID-19 pandemic led to widespread economic disruption, affecting stock prices across nearly all sectors.

- Geopolitical Tensions: Conflicts, trade wars, and political instability can create uncertainty in the markets, leading to volatility and changes in investor sentiment.

- Technological Advancements: Innovations in technology can disrupt industries, create new markets, and offer growth opportunities for companies that can adapt quickly.

- Globalization: As companies become more global, events in one part of the world can affect their operations and stock prices, even if they are based elsewhere.

Staying aware of global trends and events can help investors anticipate market movements and make informed investment decisions.

9. Case Studies: Real-World Applications of Fundamental Analysis

Case Study 1: Analyzing a Blue-Chip Stock

Consider a blue-chip company like Apple Inc. (AAPL), known for its strong financials, brand value, and consistent profitability.

- Economic Analysis: Apple operates in a favorable economic environment with strong consumer demand for technology products.

- Industry Analysis: The technology industry is highly competitive but offers significant growth potential due to rapid innovation and global demand.

- Company Analysis: Apple has a strong balance sheet, high profitability, and a loyal customer base, providing it with a competitive advantage.

By analyzing Apple’s financial statements, profitability ratios, and growth prospects, investors can determine that the company is likely to continue generating strong returns, making it a solid long-term investment.

Case Study 2: Evaluating a Growth Stock

Take Tesla, Inc. (TSLA) as an example of a growth stock known for its rapid expansion and market disruption.

- Economic Analysis: Tesla operates in a dynamic economic environment with increasing demand for electric vehicles and renewable energy.

- Industry Analysis: The electric vehicle industry is rapidly growing, with significant investment in technology and infrastructure.

- Company Analysis: Tesla has strong revenue growth, high innovation, and a charismatic leadership team, but it also faces significant competition and regulatory challenges.

Investors analyzing Tesla’s growth potential would focus on its revenue growth rate, market share, and competitive advantages to determine whether the stock is likely to continue delivering high returns.

Case Study 3: Identifying Value Stocks

Consider General Motors (GM) as a value stock that may be undervalued relative to its intrinsic value.

- Economic Analysis: GM operates in a stable economic environment with steady demand for automobiles.

- Industry Analysis: The automotive industry is mature, with intense competition but also significant opportunities for innovation in electric vehicles.

- Company Analysis: GM has a strong balance sheet, consistent profitability, and a significant market share, but its stock may be undervalued due to market concerns about industry challenges.

By comparing GM’s P/E ratio, P/B ratio, and dividend yield to its industry peers, investors may determine that the stock is undervalued and presents a buying opportunity for long-term gains.

10. Limitations and Challenges of Fundamental Analysis

Market Efficiency Hypothesis

The Efficient Market Hypothesis (EMH) suggests that all known information is already reflected in stock prices, making it difficult to consistently outperform the market through fundamental analysis. While this hypothesis is widely debated, it highlights the challenge of identifying undervalued stocks in a highly competitive market.

Unpredictable External Factors

External factors such as natural disasters, political events, and economic shocks can impact stock prices in ways that are difficult to predict through fundamental analysis. These events can create volatility and disrupt even the most carefully analyzed investment.

The Time-Consuming Nature of Fundamental Analysis

Fundamental analysis is time-consuming and requires a deep understanding of financial statements, industry dynamics, and economic trends. Investors must be willing to invest significant time and effort into their analysis to make informed decisions.

Biases and Subjectivity

Fundamental analysis involves a certain degree of subjectivity, as analysts must make assumptions about future growth, discount rates, and market conditions. Biases can influence these assumptions, leading to inaccurate valuations and investment decisions.

11. Integrating Fundamental Analysis with Other Strategies

Combining with Technical Analysis

Many investors combine fundamental analysis with technical analysis to gain a more comprehensive view of a stock’s potential. While fundamental analysis helps identify undervalued stocks, technical analysis can help determine the best time to buy or sell based on price trends and market sentiment.

Using Quantitative Analysis

Quantitative analysis involves using mathematical models and algorithms to analyze financial data and identify investment opportunities. Integrating quantitative analysis with fundamental analysis can help investors validate their findings and make data-driven decisions.

Integrating Sentiment Analysis

Sentiment analysis involves gauging investor sentiment through social media, news, and other sources. By integrating sentiment analysis with fundamental analysis, investors can better understand market psychology and anticipate potential price movements.

Long-Term vs. Short-Term Perspectives

Fundamental analysis is typically used for long-term investing, but it can also be applied to short-term strategies. For example, understanding a company’s financial health and industry position can help short-term traders identify stocks with strong potential for near-term gains.

12. Conclusion: The Path to Informed Investment Decisions

Recap of Fundamental Analysis Importance

Fundamental analysis is a powerful tool for evaluating the intrinsic value of a stock and making informed investment decisions. By analyzing financial statements, industry dynamics, economic factors, and qualitative aspects of a company, investors can gain a deep understanding of a company’s potential and make rational investment choices.

Final Thoughts on Building a Robust Investment Strategy

While fundamental analysis is a crucial component of successful investing, it should be combined with other strategies, such as technical analysis and risk management, to build a robust investment approach. By staying informed, disciplined, and adaptable, investors can navigate the complexities of the stock market and achieve long-term financial success.

Maintenance, projects, and engineering professionals with more than 15 years experience working on power plants, oil and gas drilling, renewable energy, manufacturing, and chemical process plants industries.